Top Legal Online Gambling Spots in 2025: World Money Plans

Top Europe Spots

The United Kingdom is ahead in online gambling, aiming for £9.2 billion by 2025. Malta and Gibraltar keep their spots as key gambling places, pulling operations with low tax plans and strong rule setups.

Growth in North America

The United States gambling area is growing fast, with 35 states set to allow online bets. Canada’s digital gambling world looks to hit $4.6 billion, up 300% from now.

Innovation in Nordic Lands

Sweden’s gambling world keeps rising, aiming for SEK 30 billion via top rule following and user safety acts. Nordic spots lead with safe gambling tech and strong data use for player safety.

Asia’s Market Grows

Singapore’s digital gambling world could grow 100%, pushed by mobile tech and blockchain safety. They show how old gambling ways mix with new tech changes.

Big Trends in the Field

- Mobile-first sites

- AI in safety 온카스터디

- Blockchain for paying

- Strong rules

- Rules over borders

- Real-time checks

The field’s growth looks at tech steps, rule following, and safe money moves, setting new marks for world online gambling work.

United Kingdom: Digital Game Leader

The UK’s Digital Game Spot: Top of Europe’s iGaming Wave

Market Size and Growth Plans

The United Kingdom’s watched online gambling market leads Europe’s digital play area, making £7.1 billion in 2023. Big growth to £9.2 billion by 2025 is seen, pushed by mobile bet tech and game-shifting tech steps in the iGaming field.

Rules and Mobile Game Trends

The UK Gambling Commission’s rules set world marks with deep safe gaming acts, strong money watch, and good player safety steps. Mobile game use keeps rising, with 47% of online gamblers using phones as their main bet tool. In-play sports bets make up 31% of digital bet acts.

Future Market Changes and Tech Mix

Digital Money and AI Use

Crypto use in UK game spots may grow to include 15% of trades by 2025. AI-driven personal touches are set to lift player join rates by 25%, changing how users see gaming spots.

High-Growth Areas

- Esports bets keep big speed with 41% growth through 2025

- Live dealer casino play takes 33% market spot

- 92% phone use keeps pushing digital game growth

- Top digital setups help smooth market growth

The mix of tech changes, rule top-notch, and market deepness puts the UK as Europe’s main digital game spot, aiding growth across many game types.

United States Watched Markets

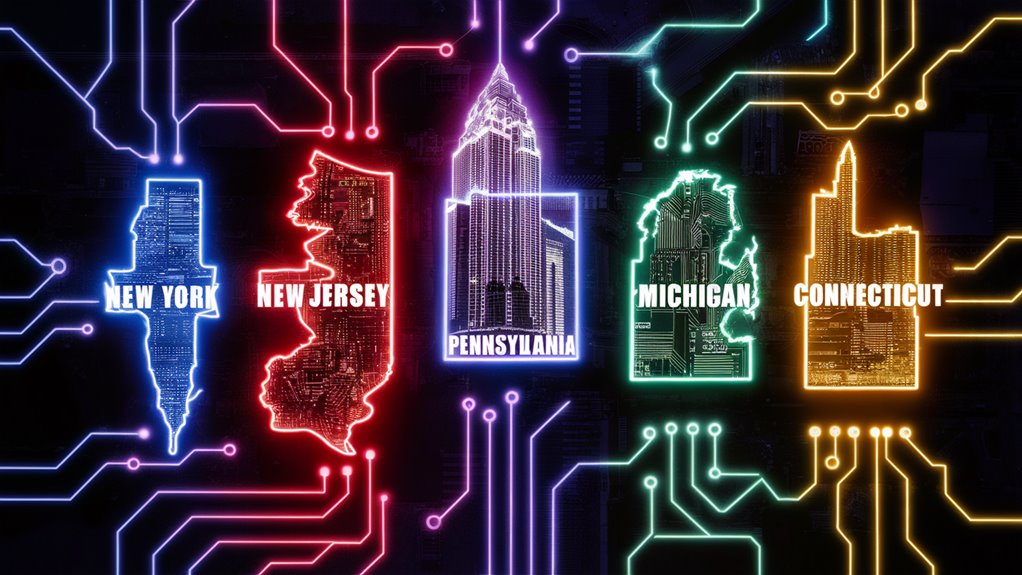

The Rise of U.S. Watched Online Gambling Markets

Market Now

The watched U.S. online gambling market has blown up since PASPA’s end in 2018, reaching $10.3 billion a year. Market leaders New Jersey, Pennsylvania, and Michigan each make over $1 billion a year in online game money. New York’s sports bet area has come out strong, taking in a huge $16 billion in bets in its first year.

Growth Plans and Market Changes

By 2025, the watched gambling scene will likely cover at least 35 states with legal online bets. Sports betting helps bring more market growth, with mobile bet spots set to cover 85% of all bets. Online casino games have big growth room beyond the six states that allow them now.

Area Chances and Market Hopes

California and Texas are key new markets that could push U.S. online gambling money past $20 billion if they allow it. These big states have huge power for the field’s growth and market size.

Operator Moves and Market Share

Top operators FanDuel, DraftKings, and BetMGM keep market lead, holding about 75% of U.S. online gambling market share. Market depth has made buying users steadier, bettering money numbers and how well all works.

Performance Numbers

- Annual money: $10.3 billion across legal states

- Mobile Betting Share: 85% of all bet acts

- Market Leaders: 75% shared market spot

- New York’s First Year: $16 billion in bets

Gibraltar’s iGaming Top Work

Gibraltar’s iGaming Top Work: A Main World Spot

Rules and Market Spot

Since its start as a top game spot in the early 2000s, Gibraltar’s online gambling part has grown into a big place with over 30 top operators and bringing in £300 million a year. The British land keeps its edge with strong rules and a good 10% tax rate on game money.

Plans After Brexit

Gibraltar’s key plans after Brexit show it keeps aiming for the top through:

- Better license deals with the UK Gambling Commission

- Top data safety lined up with EU needs

- Safe gambling new tech like AI-led safety tools

- Strong KYC steps for operator check

Market Growth and New Things

The land’s iGaming market has strong growth hopes through 2025, with plans showing:

- 15% yearly growth in the area

- Mobile game growth across spots

- Crypto payment mix for better trades

- Special game courts for fixing fights

Setup and Work World

Gibraltar’s place as a top-tier spot is backed by:

- World-class setup backing major operators

- Full cyber safety plans

- Big names like Bet365 and 888 Holdings here

- Tech new moves in game works

- Rule following top work

This cool setup keeps Gibraltar as a main global gaming spot, pulling top operators and aiding field new steps.

Malta’s Key Gaming Spot

Malta: Europe’s Main iGaming Spot

Key Gaming Spot Lead

In the heart of Mediterranean gaming new steps, Malta keeps its top spot as Europe’s main iGaming spot, with over 300 licensed operators making €$.6 billion a year in gross gaming money (GGM). The island’s key place has made a one-of-a-kind setup for gaming top work.

Rules and Market Get-In

The Malta Gaming Power (MGA) puts out a full license setup covering lots – from sports bets to casino games. This one setup, mixed with tough rule standards lined up with EU rules, lets top game brands easily get into the European market.

Setup and Tax Edges

Tech Setup

Malta’s top tech setup has:

- 95% fiber-optic network cover

- Many subsea cable links Treatment and Prevention Programs

- Double link setups

- State-of-the-art data hubs

Good Tax World

The spot’s low corporate tax plan, with a 5% cap for game companies, gives big work edges and pulls global operators looking for the best money setup.

New Growth and New Things

The plan for Malta’s iGaming area shows 8.2% yearly growth through 2025, pushed by:

- Blockchain game mix

- Crypto payment ways

- Virtual sports growth

- Esports bet steps

Malta’s team of 12,000+ game pros and set bank ties put the spot at the front of new market chances, making it a main global gaming spot.