Integrating Multi-Strategy Betting to Maximize Success

Building the Foundations of a Long-Term Betting Strategy

A systematic hedge providing for prescriptive betting based on position diversification, strategic capital allocation, and timing optimization. This strategic combination of betting styles lays down a solid foundation for consistent profit-making.

Core Portfolio Distribution Model

The allocation of bankroll across different levels of risk adheres to a tested distribution model:

- Conservative methods: 30% allocation

- Moderate risk plays: 50% allocation

- HPAs: 20% allocation

- Individual bet limits: 2% max exposure

Protocol for Tracking and Adjusting Performance

Strategic optimization requires close tracking of key metrics:

- Win rate analysis

- Monitoring Return on Investment (ROI)

- Market indicator assessment

- 25% revised move focused on higher incremental development

- 2-3 session testing periods

Foundations of Core Betting Style

Foundations of Core Sports Betting Strategy

To avoid unforced errors, three principles of sports betting strategy apply to all major markets and competitions.

Position Diversification

The best strategy for bankroll management is to hedge your account to maintain flexibility in your position. This is best done by diversifying bets across multiple markets rather than focusing heavily on one type of play. This naturally hedges the risk while capturing opportunities for value across various competitions and leagues.

Capital Allocation Framework

It’s important to stick to a rigid bankroll management strategy based on past performance data. Develop a plan to distribute higher stake percentages on tested betting systems with a higher success rate while keeping smaller ones at novice or high-risk possibilities. Such a staggered progression allows for fractional bankroll increases without the risk of core wagering capital.

Timing Optimization

Market timing analysis is crucial, requiring the study of seasonal relationships and historical insights. Monitoring how specific markets act during critical times allows for tailored positioning. High-probability opportunities aligned with solid statistical indicators should be met with increased stake size accordingly.

Risk Management Across Strategies

Multi-Layered Risk Control Implementation

Proper bankroll management and 지속 가능한 블랙잭 strategic allocation are the cornerstones of risk management in sports betting.

- 30% to conservative betting strategies

- 50% to moderately risky positions

- 20% allocated to intentional, calculated high-risk scenarios

Loss Prevention and Position Sizing

Strict bankroll management has several layers of defense:

- 2% max risk per trade

- Max range per exposure: 10% per day

- Limits on both individual position levels and daily losses

Ensuring Strategy Diversification with Portfolio Correlation Analysis

- Analyze betting strategies against existing risk exposure

- Identify and reduce overlapping risk areas

- Adopt hedging betting strategies

Strategic Hedging Methods

Risk-balanced betting consists of:

- Top positions on favorites with strong fundamentals

- Hedging with secondary prop and alternate lines

- Galepeak Blackjack

- Offset positions calculated to lower downside exposure

Choose Your Style Based on Market Analysis

Understanding Market Dynamics

Analysis of market efficiency is central to successful betting strategy development. Tracking how quickly odds respond to new information helps bettors isolate ideal market sectors for their preferred strategy.

Volume Pattern Assessment

Trading volume analysis provides key insight into betting styles:

- High-volume markets benefit momentum-based and trend-following strategies

- Low-volume markets suit contrarian betting strategies and value-based positions

Line Movement Dynamics

Tracking odds movement provides market structure information:

- Price sensitivity to betting action

- Overreaction tendencies

- Stability metrics

- Sharp money influence

Switching From One Betting System to Another

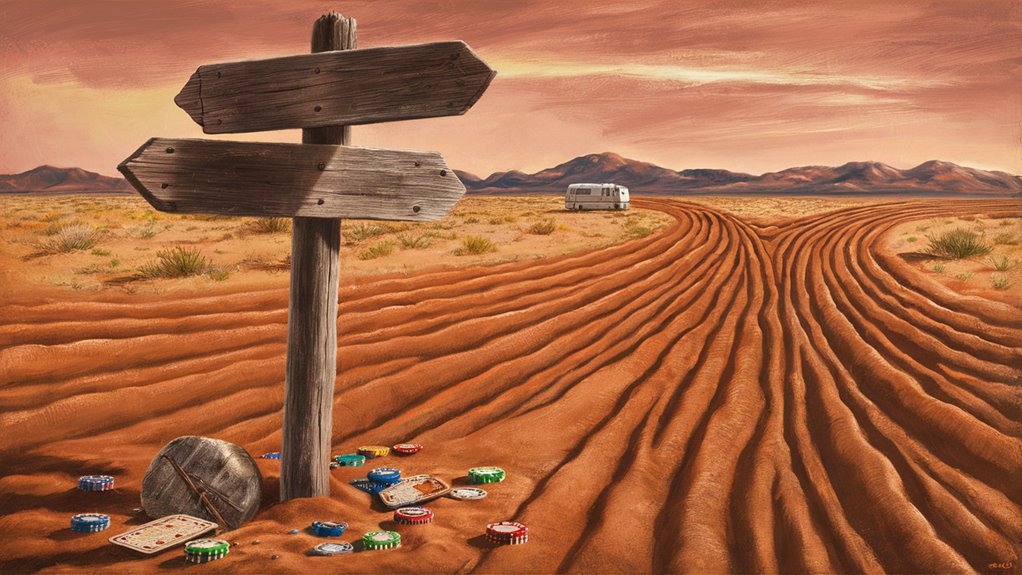

Strategic Betting Switch: Combining the Best of All Techniques

Professional betting methods continuously evolve based on market conditions and emerging opportunities. Successful transitions between betting styles are built on strategic timing, risk management, and identifiable transition triggers.

Employment of an Aggressive Strategy

Transitioning to aggressive positions requires monitoring market momentum indicators:

- Increased market volatility

- Enhanced trading volume

- Technical breakout patterns

- Positive trend confirmation

Position scaling in 25% increments allows for validation and optimization.

Defensive Position Management

Risk mitigation strategies include:

- Position size reduction

- Cash reserve optimization

- Win rate analysis

- Drawdown assessment

- Lotus & Luxe Slots

- Market sentiment evaluation

Hybrid Transition Framework

Overlapping systematic 카지노사이트 추천 periods of 2–3 trading sessions enable:

- Strategy validation

- Bankroll protection

- Risk-adjusted returns

- Performance monitoring

Building Your Hybrid System

Creating a Hybrid Betting System That Wins

Core System Development

A successful hybrid betting system combines different strategic approaches into a cohesive methodology. Start with two complementary staking methods that have been tested, then integrate additional strategies logically. The most effective systems fuse positional betting with a data-driven approach, ensuring a reliable verification mechanism for trading signals.

Strategy Integration

Defining clear transition triggers between different approaches is key. Identifying market conditions that signal a strategy shift ensures consistency. The core methodology should serve as a base, with secondary methods reinforcing weaknesses or adding strength where needed.

Performance Optimization

Every system element how seasoned poker players capitalize should be documented, and performance metrics tracked meticulously. Position sizes must be controlled while recording win rates and ROI metrics. Strategy switches should be dictated by:

- Market volatility conditions

- Statistical performance indicators

By systematically evaluating these factors, bettors can build a hybrid system that remains profitable and adaptable over time.