Skip Crypto Gambling: Key Tips for Wise Investing

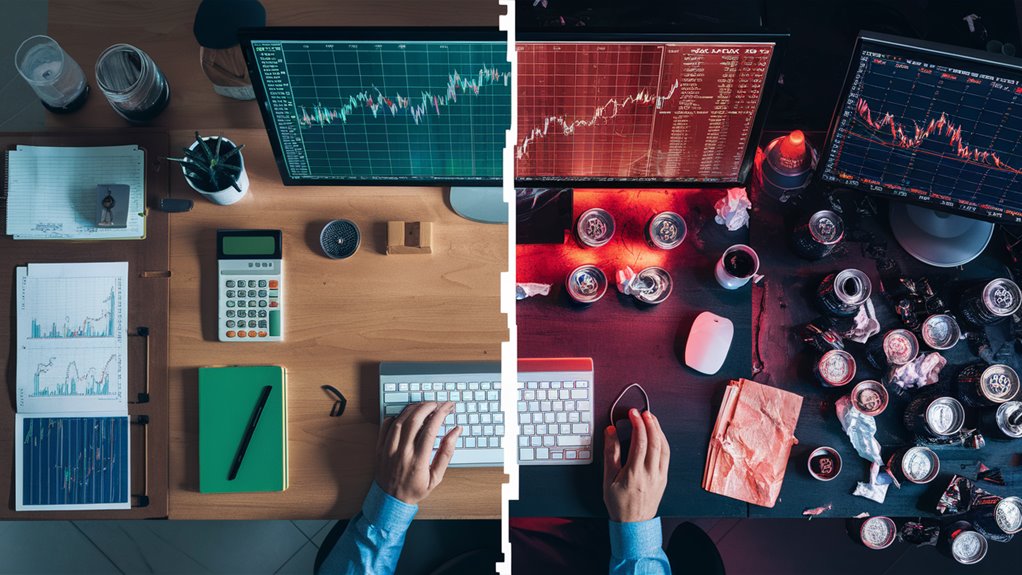

Smart Crypto Investment vs Gambling

The big difference between smart cryptocurrency investing and gambling is using plans and risk rules. Position sizing of 1-2% per trade is key for safe investing, keeping your money safe from big losses.

Needed Risk Rules

Records and Checks

- Keep full trade logs

- Mark entry/exit spots

- Watch performance numbers

- Study trends and results

Set Trading Ways

- Use set entry/exit plans

- Put in firm stop-loss orders

- Use tech checks

- Try portfolio mix

Common Traps to Stay Away From

Trading on Emotion

- Constant price checks

- Chasing losses

- Decisions driven by FOMO

- Sharp Table Crescendos

- Too much trading

Making a Lasting Plan

To build a data-led investment way, you need:

- Orderly market checks

- Regular portfolio changes

- Sizing positions based on risk

- Control over emotions

Focus on setting up a strong investment framework instead of hunting quick wins. Success in cryptocurrency needs patience, studying, and sticking to tried investment rules.

Signs of Crypto Gambling Addiction

Key Behavior Signs

Cryptocurrency trading addiction shows up with key signs that mix old gambling habits with new digital urges.

Constant price watching and checking your portfolio many times an hour are main signs, along with quick trading choices driven by FOMO or market shakes.

Money Risk Signs

Chasing losses is a big red flag in crypto gambling.

Risky investing more than you can lose and taking loans for trading show a big problem. Watch out for:

- Going past money limits

- Borrowing money for trades

- Skipping crucial bills

- Hidden trading acts

Life and Feelings Impact

Compulsive trading habits often shake up your daily life. Look for these warning signs:

- Sleep trouble from constant market checks

- Falling work results

- Strain in relationships from trading obsession

- Mood swings tied to market changes

- Pulling back from friends to focus on trades

Trading Mindset Red Flags

Emotional trading choices in cryptocurrency often show up as:

- Panic sells in downturns

- FOMO buys in rallies

- Too much time digging into crypto

- Drawn to get-rich-fast ideas

- Backing up investments without solid checks

Smart Investment Vs Emotional Trading

Grasping Investment Ways

Smart cryptocurrency investment calls for a methodic, data-led focus aiming for long-term value.

Good investors set up full investment plans including detailed market checks, technical signs, and basic research.

These methods put clear thinking over quick emotional trades.

Main Parts of Smart Trading

Smart investors use:

- Portfolio mix

- Risk control rules

- Sizing guidelines

- Stop-loss steps

- Tech study setups

Traps of Emotional Trading

Market shakes often spark emotional replies that lead to not so good trade choices.

Common emotional trading habits are:

- Panic selling in price drops

- FOMO buying in price jumps

- Too leveraged spots driven by greed

- Dropping set plans under stress

Building a Smart Frame

Good cryptocurrency investing needs:

- Deep market study

- Clear entry and exit ways

- Sizing positions right per risk

- Regular portfolio switches

- Performance documentation

- Trade checks and bettering moves

Must-Follow Risk Rules

Pro traders keep tight risk checks through:

- Limits on position size

- Stop-loss placing

- Portfolio mix numbers

- Limits on gearing

- Plans to keep capital

This set way sets apart smart investment from hopeful trading and helps make sure of long-term market wins.

Best Risk Rules

Musts for Position Sizing and Portfolio Running

Position sizing is key for doing good in cryptocurrency trade risk control.

Use firm rules to limit exposure to 1-2% of full portfolio worth in each trade. This safe plan keeps your portfolio through market ups and downs and potential low periods.

Setting Stop-Loss Right

Stop-loss orders are big in keeping you safe in shaky cryptocurrency markets. Set firm exit spots before entering a position and stay strict in making them happen.

Define clear price aims and risk limits to take out emotional choices from trading.

Ways for Portfolio Mix

Smart diversification across different cryptocurrency assets and market areas is key for lowering risk. Mix your holdings between:

- Big-cap tested cryptocurrencies

- Mid-cap new projects

- Sector-specific tokens

- Stablecoins for keeping capital

Handling Money and Gearing

Wise use of money stays very important in cryptocurrency trading. Stay away from geared spots unless you really know the market.

Keep enough cash of 20-30% to use in market lows and new chances.

Keeping Watch and Checks

Set up full trade records through detailed tracking. Record:

- Entry and_exit spots

- Reasons for positions

- Market conditions

- Performance numbers

- Risk/reward numbers

Analyze trading ways through steady performance checks to better risk rules and make better choices over time.

Making a Long-Term Plan

Plan for Smart Investment

Making lasting wealth through cryptocurrency needs planned plans and careful doing over long times.

Set clear investment goals, find right risk levels, and build specific entry and exit rules.

Use set limits for assets, position sizing guides, and schedule for portfolio changes to keep things balanced.

Mixing Portfolio and Asset Control

Doing well in cryptocurrency investing asks for smart mix across different blockchain parts, market sizes, and tech uses.

Keep a careful part of 5-10% in your full investment mix, focusing mostly on known cryptocurrencies like Bitcoin and Ethereum.

Use regular-cost buying ways to cut timing risks and lower emotional trading choices.

Watching Performance and Refining Plans

Do quarterly portfolio checks to look at https://maxpixels.net/ performance numbers, switch holdings, and change parts based on market conditions.

Keep full investment records for each holding, including clear entry points, exit aims, and strategic reasons.

Track all moves well to make better choices and lift long-term investment wins through data-led studies.

Risk Rules to Follow

- Set firm limits on position size

- Use stop-loss tools

- Watch market link factors

- Check liquidity needs

- Look at rules to follow

- Check tech risks

Common Crypto Trading Mistakes

Too Much Trading and Market Exposure

Too much trading is one of the top mistakes in cryptocurrency trading, quickly using up trading cash through too many positions.

Traders often make too many moves because of FOMO (Fear of Missing Out) or just being bored, leading to more costs and more risk to market moves.

Gearing Rules and Risk Control

Trading with too much gearing is a big error in cryptocurrency. While gearing can lift possible wins, it often ends in losing money during normal market moves.

Gearing rules are very important for new folks to cryptocurrency trading, where careful ways often bring better long-runs.

Smart Position Rules

Always using stop-loss is key for long trading wins. Cryptocurrency markets can change a lot in a short time, making strong risk rules a must.

The habit of chasing market rises and buying into big upward moves often turns traders into easy exits for earlier market players.

Trading on Emotion and Market Mindset

Emotional trading choices often hurt trading results in cryptocurrency markets.

Key shows are panic selling during market drops and keeping losing spots longer than needed.

Good trading asks for careful doing and sticking to set trading plans, no matter the market states.

Must-Follow Risk Rules

- Use firm rules for position sizing

- Keep using stop-loss ways

- Make clear rules for entry and exit

- Watch overall mix exposure

- Record trading choices and check results often