The Mind Side of Crypto Gambling: Basic Truths

How Your Brain Reacts

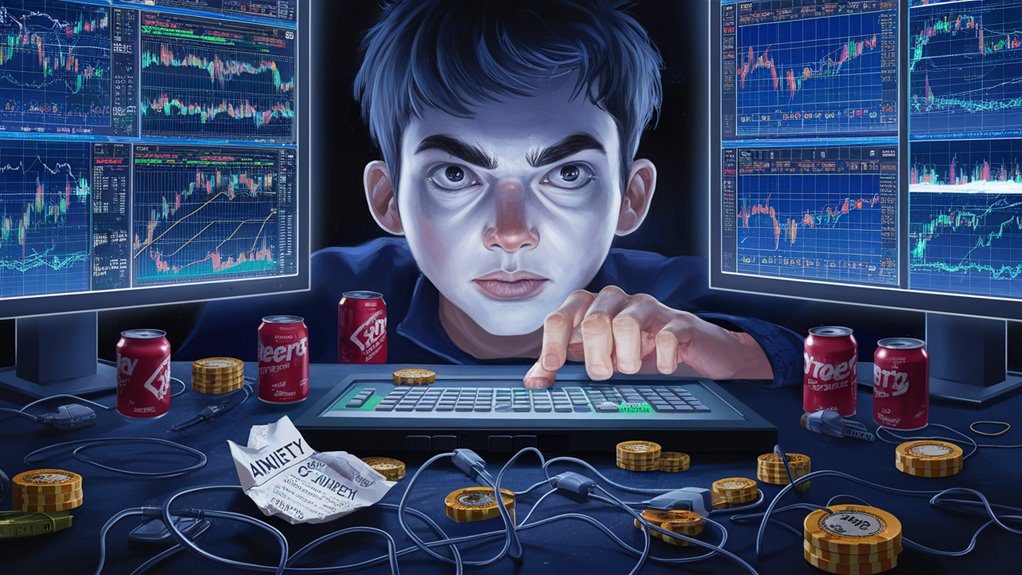

The way we trade cryptocurrency messes with basic brain reward paths, causing strong mind reactions like in old-style gambling. All-day market hits and wild price changes set off big dopamine boosts, making traders form addictive habits.

Community Buzz and Trade Moves

Social media talk and online groups shape trading choices a lot. Studies show that traders deep in these groups make 41% more trades, picking gut reactions over cool thinking. This need to fit in feeds the fear of missing out (FOMO), pushing risky trade moves.

Charts and Mind Tricks

Seeing chart patterns and using analysis tools give a fake sense of power, making for big over-confidence. Traders think they can predict market highs and lows, which leads to:

- Larger bets

- Longer trade times

- Higher risk will

- Expert Opinions

- Less checking

Stress and Bounce-back Tries

Losses fire up sharp stress reactions that mess up clear thinking and smart choices. This usually leads to:

- Bold comeback tries

- Making choices based on emotion

- Short thinking times

- Bigger risks taken

Knowing these mind moves helps us make good risk plans and keep cool in trading.

The Brain Side of Crypto Ups and Downs

Getting Why Dopamine Drives Us

Crazy price waves in cryptocurrency start strong brain reactions just like in old-school gambling fun.

The brain’s happy center kicks in by mixing risks seen and possible gains hoped for.

Traders hooked on market waves have brain actions that match those in casino gaming, with mood lifts happening no matter the real money result.

The Never-Closing Market

The non-stop nature of crypto markets sets up an intense mental space.

Unlike old money markets with set times, crypto’s always-open doors boost the hunt for dopamine.

This ongoing market chance can show up as:

- Checking prices all the time

- Same trading moves often

- Sleep problems

- Long screen times

Big Moves and Mind Effects

Huge price jumps in crypto markets hit our brains much harder than usual assets do.

While normal markets hardly see big one-day moves, crypto price dances often show:

- 20% or more changes in a day

- Big emotional jumps

- More reward hunts

- Bolder risks

All these mix into a strong mind feedback look, where traders feel growing dopamine hits with market moves, changing how they judge risks and choices.

Getting the Crowd Follow and FOMO in Crypto Markets

The Mind of Crypto Trading

Fitting in, fear of missing out (FOMO), and buddy push are big drivers in market moves.

Market mind studies show traders often base calls on what everyone does, not deep analysis.

Social sites feed this, where a high mood pulls others in, creating circles that make everyone feel they have to join.

FOMO in Crypto

FOMO mind tricks start when investors see others making big money, sparking a deep need to not be left out.

This mind push often makes folks buy too much at market highs.

Stats show 67% of crypto traders act mainly from FOMO.

Fitting in and Market Push

The crowd proof chain starts when known folks or buddy circles say yes to specific cryptocurrencies, making them seem more real.

This often skips cool thinking, pulling folks to follow the herd.

Studies show that traders in crypto groups trade 41% more than lone traders.

Smart Trading Through Mind Knowing

Seeing these group ties lets traders tell apart moves driven by feeling from those based on plan.

Keeping an eye on these mind pulls is key to develop good trading habits and stay sharp in markets.

Social Sites and Trade Calls

Chatting on socials changes crypto trading a lot, linking networks where market feelings spread fast.

These web spots boost both good and bad market news, leading to faster price moves and more wild ups and downs.

Think You Control It? Crypto Trading Says No

The Mind Behind Trading Control Mistake

The fake feeling of control messes up a lot of crypto traders, where folks think they can sway market ends.

Trading acts get pushed a lot by this mind trick, making traders too sure in their brain work and choice power.

Charts and Fake Sureness

When crypto traders dive into deep chart study, they often feel too sure about market flows.

The tie between sorting info and felt control makes a risky mix – the more data traders sift through many signs and chart paths, the bigger their control trick grows, even as crypto markets stay wild at heart.

Risk Plan Effects

Trade Dangers Seen

Good risk plans often fail when traders fall for control tricks. Those feeling big market power often show:

- Bigger bets

- More trades

- Less care for key market parts

- Ignoring what’s happening outside

Market Waves and Thinking

The wild side of crypto markets makes the bad sides of control tricks more likely.

Traders need to know that deep study and good plans, while good, can’t promise certain market ends. Being aware of this mind trap helps keep trading choices balanced and real in the lively crypto trading world.

Web You and Crypto Trading Risk Moves

How Web Faces Change Trading Mind

Digital trading spots change how crypto traders make and show their web selves, really shaping their risk-taking ways in the money markets.

Trading under fake crypto names makes a clear cut between real-life you and trading moves, changing how we see and manage risks.

Knowing Web Boldness in Trading

The web bold effect shows up when traders work in crypto markets with fake profiles.

This mind thing shows when folks trade under web nicknames or fake names, often making for more will to take risks and bolder trade moves.

Being apart from real persona often leads to stronger high-risk trading acts.

Risk Plans in Digital Trade Spots

The mind sides of crypto trading go beyond just money.

The mix of web faces and trading mind sets up hard spots for risk plans.

Traders must really watch and check how their web self changes their risk-will levels and choice steps to keep good trading habits.

Set Rules for Smart Trade

Trading minds in digital markets need special ways to handle risks.

Winning crypto traders build clear steps to:

- Watch and judge their risk-taking moves

- Keep steady trading habits even when hidden

- Set firm risk rules

- Mix bold chances with wise plans

- Check trading acts often

Getting these mind bits helps traders make more cool investment moves while working in digital markets, leading to better trading wins in the end.

Know the Almost-Win Feel in Crypto Trading

The Mind of Almost-Wins in Crypto Markets

The almost-win feel is a big mind pull in crypto trading, where traders get big emotion jumps when plays nearly hit gain lines or stop-loss points.

These almost-win times start strong mind reactions, waking up the same brain paths seen in gambling fun.

Effects on Trade Moves and Choices

Trading mind studies show that almost-wins in crypto markets shape later trading steps a lot. Traders with almost-wins often show:

- More risk in moves

- Bigger bet sizes

- Choices based on emotion

- Try-hard comeback plays through daring trades

Risk Plans for Almost-Win Times

Set Safe Steps

- Start auto stop-loss steps

- Set firm gain aims

- Use bet size rules

- Keep trade logs to track almost-win paths

Mind Checks

- See almost-wins as full losses

- Keep cool

- Avoid hands-on trade tweaks in wild times

- Build structured trade plans

Market Waves and Almost-Win Rates

Crypto ups and downs make almost-win moments common, mainly during:

- Big market swings

- News times

- Break points in charts

- 온카스터디

- Busy trade times

Knowing and handling the almost-win effect is key for keeping good trade plans in wild crypto markets.

Know the Chasing Loss Feel in Crypto Trading

The Mind of Loss Chasing

Chasing loss moves show one of the worst mind patterns in crypto trading and gambling.

Traders up their risk hits in mad tries to get back past losses, making a bad loop of upping stakes and less wins.

Mind Paths Behind Loss Chasing

The deep mind game starts from prospect theory, where losing hits our feelings harder than same-sized gains.

When seeing a 50% drop in crypto plays, the brain starts a big stress move that messes up smart choices. This mind play often shows up through:

- Quick bet doubling

- More will to risk

- Short choice times

- Less brain work

Addiction Patterns and Trade Moves

Research shows that chase-loss moves wake up the same brain paths as stuff addiction, making this act hard to stop. Main signs of chase-loss include:

- Higher bets despite bigger losses

- Shorter trade times

- Less risk checks

- Choices driven by feelings

Ending the Chase-Loss Loop

To fight chase-loss trends, traders must set strong risk steps and keep bet sizes set.

Knowing the mind pulls behind loss-chasing helps build better trade habits and keep cool during market ups and downs.